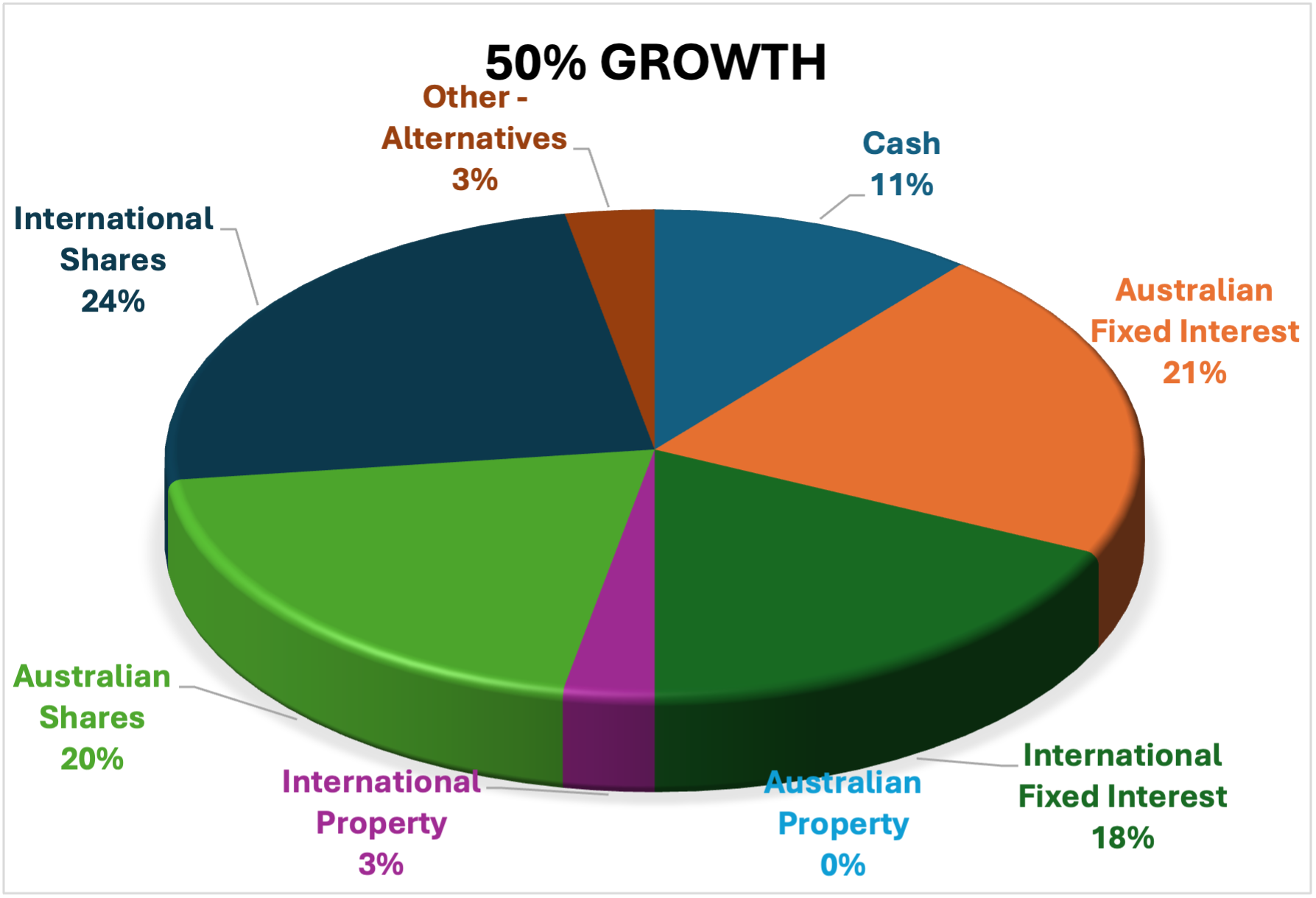

50% Growth

Your long-term investments will be spread across shares, property, fixed interest and cash. The allocation is evenly weighted - 50% to cash and fixed interest, and 50% to property and share investments. This will provide a stable income and can withdraw capital to supplement income if necessary. You can expect small fluctuations in income to gain modest capital growth.

You require minimisation of downside risk. Minimum suggested timeframe is 5 years.

| 50% Growth Risk Profile | |

|---|---|

| *Projected return per annum | 5.97% |

| ^Extreme return range | -13.50% to 25.40% |

| +Normal return range | -3.70% to 15.70% |

| Probability of a negative return (over 1 year) | 17.83% |

| Minimum suggested investment timeframe | 5 years |

| Investment objective over investment timeframe | CPI + 1.25% |

* This is a projection and not a guarantee that you will achieve this return.

It assumes pension tax rates and includes franking credits. The returns are prior to any costs.

^ Approximately 99% of annual results are expected to fall in this range.

+ Approximately 66% of annual results are expected to fall in this range.