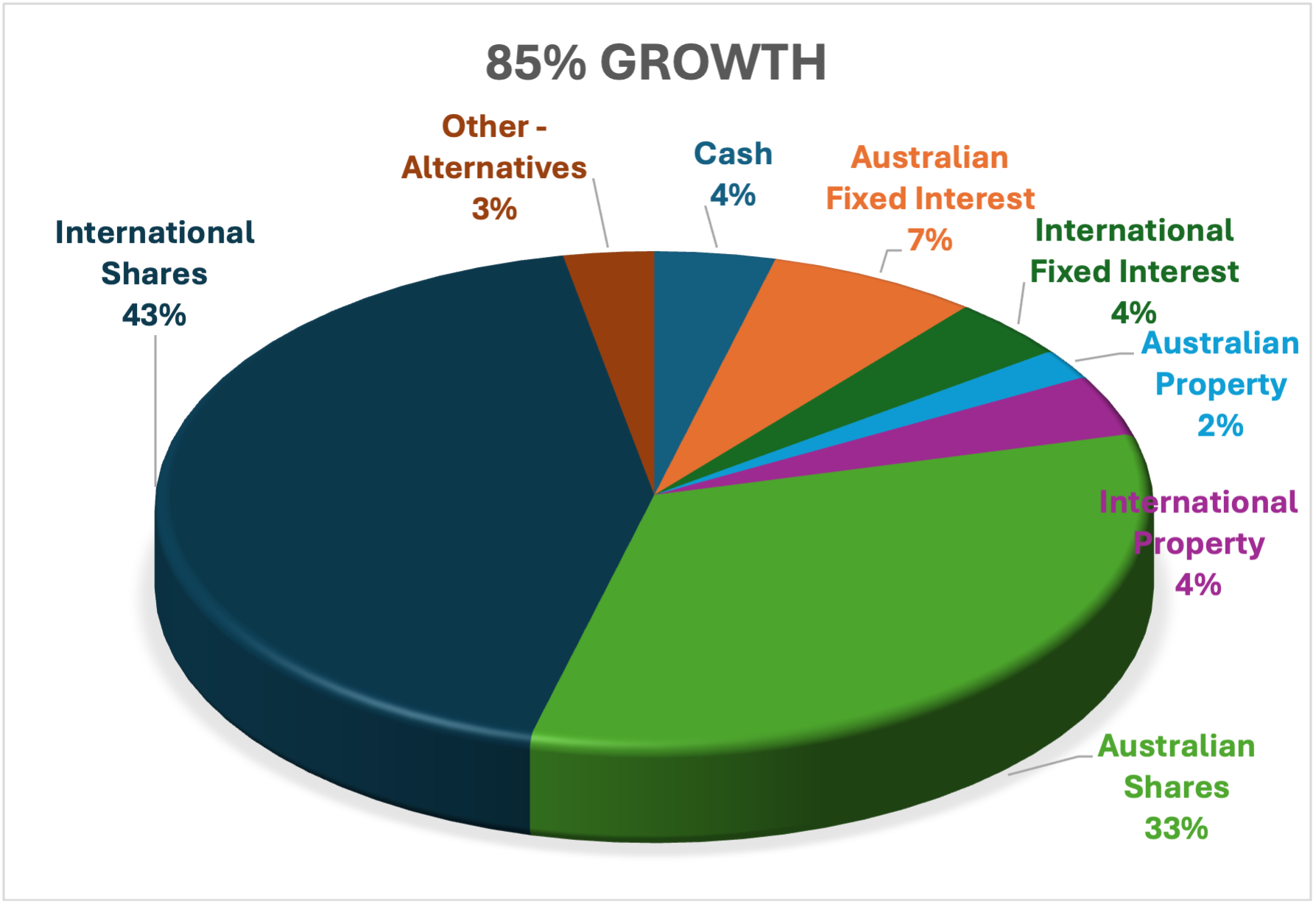

85% Growth

Your long-term investments will be spread across shares, property, fixed interest and cash. The asset allocation will focus on growth investments, with 85% of your money allocated shares and property. You have little or no need for an ongoing current income from investments. Your investment focus is on achieving capital growth with no need to access capital in the medium term.

You are prepared to accept fluctuations in capital value to achieve longer term wealth accumulation. Minimum suggested timeframe is 8.5 years.

| 85% Growth Risk Profile | |

|---|---|

| *Projected return per annum | 7.42% |

| ^Extreme return range | -24.20% to 39.10% |

| +Normal return range | -8.40% to 23.20% |

| Probability of a negative return (over 1 year) | 24.08% |

| Minimum suggested investment timeframe | 8.5 years |

| Investment objective over investment timeframe | CPI + 3.00% |

* This is a projection and not a guarantee that you will achieve this return.

It assumes pension tax rates and includes franking credits. The returns are prior to any costs.

^ Approximately 99% of annual results are expected to fall in this range.

+ Approximately 66% of annual results are expected to fall in this range.